Taxing Unrealized Gains???

South Dakota was first to implement a version of Obamacare before there was a President Obama. It seems we’re also a leader in other government schemes to take what you own and "equalize" it.

“I have never understood why it is "greed" to want to keep the money you have earned but not greed to want to take somebody else's money.”

― Thomas Sowell

Can You Tax What I Ain’t Got?

Economist Steven Moore recently explained and blasted the Democrat plan for the Feds to tax UNREALIZED GAINS. Their proposal is not limited to financial investments.

His example was along these lines:

Let’s say you own and live in a house that you bought for $75,000. Then, because of skyrocketing inflation and uncharacteristic migration into your geographical area, the “market value” of your house jumps to $200,000 in one year. That value really doesn’t do anything for you unless you sell the house — or REALIZE the gain in value. As long as you don’t sell the house, that increased value is theoretical — it is UNREALIZED GAIN.

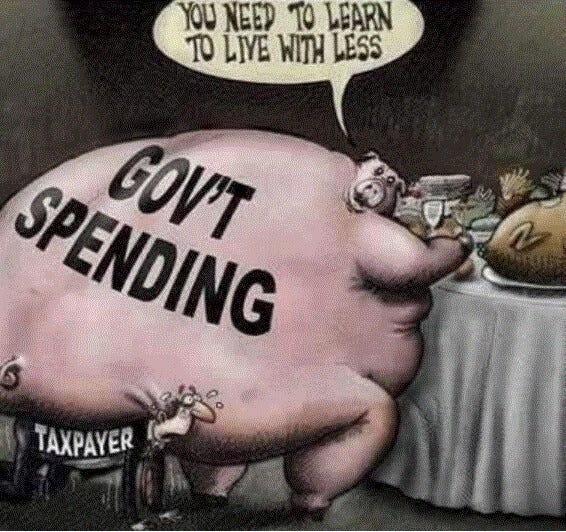

You don’t have an extra $125,000 laying around (the difference between your $75,000 purchase price and the “increased value”). The Democrats (and some Republicans) want to tax that increased value as though it is income. Shocking, isn’t it?

We Were There First!

Well guess what: That is exactly how South Dakota property taxes are assessed — in Lincoln County at least. People who have owned and occupied their homes for decades are facing reassessments based on current market values of houses sold in their vicinity. Those sellers next door REALIZED a gain. The people who just want to live in the house they own are not realizing a gain. Yet their reassessments are based on transactions in which they had no part.

This travesty is the process laid out by law in a state with a majority Republican legislature. With the massive influx of blue-state refugees bearing cash, people who have lived and worked in South Dakota their whole lives are being put in an untenable position: significantly reduce their standard of living to pay skyrocketing property taxes at the same time they are paying for skyrocketing food and fuel costs. Or sell the house. And then what?

Here is a recording of the Lincoln County Department of Equalization meeting on March 9 that explained how assessments are being done. It’s long — over two hours. But you might want to give it a listen, and then contact your state representative.